|

PORT AUTHORITY

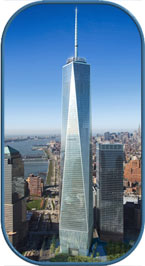

WANTS TO SELL WORLD TRADE CENTER BUILDING

The Port Authority of New York and New Jersey is

looking for a "partner" in its quest to build a new World Trade

Center complex in New York.

"As 1 World Trade Center continues to

rise into the city skyline, the timing is right to determine whether

there is a strategic partnership that can add long-term success into

the building," announced Stephen Sigmund, the Port Authority's chief

spokesman.

Late last year, the authority asked a small, exclusive group of

commercial real estate property owners and developers to place bids

for part-ownership of the project, according to New York Times

reporter Charles Bagli. When completed, probably in 2013, the

105-story building will stand 1,776 feet tall, according to the

patriotic plans. It is expected to be one of the most expensive

commercial buildings in the United States. The authority is counting

on the partner it chooses to market the project, not an easy task

considering the current recession in commercial real estate the city

is going through.

"There's a substantial amount of real estate equity capital looking

for the right investment," said Michael Rotchford, executive vice

president of Cushman & Wakefield, who is conducting the authority's

search for the right partner. "We think this is potentially one of

the best real estate investments available in New York."

HIGH 'WALK

SCORES' BOOST HOME VALUES

A

recently published study suggests a home's value is somewhat

dependent upon how practical its neighborhood is for walking. The

study was sponsored by CEOs for Cities, a Chicago-based nonprofit,

which bills itself as "a national cross-sector network of urban

leaders from civic, business and philanthropic sectors dedicated to

building and sustaining the next A

recently published study suggests a home's value is somewhat

dependent upon how practical its neighborhood is for walking. The

study was sponsored by CEOs for Cities, a Chicago-based nonprofit,

which bills itself as "a national cross-sector network of urban

leaders from civic, business and philanthropic sectors dedicated to

building and sustaining the next

generation of great cities." It was written by Joe Cortright,

president and chief economist of Impresa, Inc., a consulting firm

out of Portland, Ore., that specializes in metropolitan economics.

"The walkability of cities translates directly into increases in

home values," Cortright wrote in the report, entitled "Walking the

Walk." "Homes located in more walkable neighborhoods, those with a

mix of common daily shopping and social destinations within a short

distance, command a price premium over otherwise similar homes in

less walkable areas."

Homes at most metropolitan addresses in the United States have their

walkability measured on the Web site Walkscore.com, with zero for an

area where residents are totally vehicle-dependent and 100 where

everything someone needs is within a short walk. The study compared

the Walk Scores with sales figures of 90,000 homes in markets

throughout the country before announcing its conclusion.

"After controlling for all other factors that are known to influence housing value, our study showed a positive correlation

between walkability and housing prices in 13 of the 15 housing

markets we studied," Cortright wrote. "In the typical market, an

additional one point increase in Walk Score was associated with

between a $500 and $3,000 increase in home values."

HOME OWNERSHIP

RATE PREDICTED TO DECLINE

A study conducted by the Federal Reserve Bank of New

York concluded with the prediction that the U.S homeownership rate

will continue to drop. In a staff report, entitled "The

Homeownership Gap," Federal Reserve economists Andrew Haughwout,

Richard Peach and Joseph Tracy noted that the homeownership rate in

this country reached an all-time high of 69% in the

third quarter of 2006 and dropped 1.7% over the next three years to

67.3%, which was the lowest it had been since the second quarter of

2000.

Increasing unemployment and foreclosures, combined with decreasing

housing prices have led to this rate decline, the report said. The

economists noted the higher percentage of negative-equity

households, where more is owed on the mortgage than the home is

worth, and said this trend will lead to less "household

mobility," due

to the fact that people in this situation "need to delay a move

during the period they are rebuilding their savings." They site

Census reports to point out that "the number of households moving is

at its lowest point since 1962."

"The current severe house price cycle, combined with borrowers who

had little or no equity at origination of their mortgages, has led

to a dramatic rise in homeowners with negative equity," the report

said in its conclusion. "This situation is likely to put downward

pressure on future homeownership rates, and has potentially

important implications for the maintenance of the

housing stock, the stability of neighborhoods, and future household

saving behavior."

OVERVALUED

MARKETS STUDY A REVERSAL OF FOUR YEARS AGO

Unlike its study four years ago, when it concluded

most homes in the United States were undervalued, CNNMoney.com found

the reverse to be true in its recently released report on overvalued

and undervalued housing markets late last month. The study looked at

330 markets (metropolitan areas) in the United States and concluded

that 242 of them are undervalued because it considered their homes

to be priced less than fair market value. Only 87 markets were

overvalued, according to the study.

In January 2006, CNNMoney.com's ranking of U.S. housing markets

indicated that out of 299 markets studied, 213 were overpriced.

Needless to say, a burst in the bubbled housing market has occurred

since then.

Today, the two best-known cities for gambling in the United States

are at opposite ends of the 330-market study. Atlantic City, N.J.,

is considered by the CNNMoney to be the most overvalued market (at

30.2% over fair market value), while Las Vegas (at 41.4% below fair

market value) is considered to be the most undervalued. Following

Atlantic City in the overpriced category are Wenachee, Wash. (28.9%)

and Ocean City, N.J. (26.6%) Following Vegas in the bargain market

territory are Vero Beach, Fla, (- 39.8%), Merced, Calif. (-37.7%)

and Cape Coral, Fla. (-36.8%).

Les Christie, staff writer at CNNMoney, said that the ratings came

from a combination of data on "Median home prices, local interest

rates, population densities and income, plus historical premiums or

discounts that areas have exhibited over time." The statistics came

from National City Corp. and HIS Global Insight.

"I've done some research that shows when you get a bubble, you don't

get a return to normalcy," said Richard DeKaser, who engineered the

report for National City. "You go past normalcy for a long period of

undervaluation."

ASK MARTITIA

QUESTION:

Can an appraiser use the same appraisal report to communicate

multiple, appraisal intended uses, along with a single value, and be

in compliance with USPAP? QUESTION:

Can an appraiser use the same appraisal report to communicate

multiple, appraisal intended uses, along with a single value, and be

in compliance with USPAP?

MARTITIA: Yes, as long as the intended uses are performed with

the same scope of work and have the same type and definition of

value. In order to be in compliance with the Uniform Standards of

Professional Appraisal Practice, the appraiser must identify all of

the intended uses of the appraisal

opinions and designated values in the appraisal report.

Martitia Mortimer, Elliott’s executive vice president, answers

appraisal questions on a regular basis in Elliott Real Estate

News.

QUOTES

"A

baby is born with a need to be loved, and never outgrows it."

–

Frank Howard Clark "A

baby is born with a need to be loved, and never outgrows it."

–

Frank Howard Clark

"World War II was the last government program that really worked."

–

George Will

"May your walls know joy, may every room hold laughter, and every

window open to great possibility."

–

Mary Radmacher

"Always bear in mind that your own resolution to succeed is more

important than anything else."

–

Abraham Lincoln

"It's the most unhappy people who most fear change."

–

Mignon McLaughlin

|

| |

| Newsletter Editor:

kevin@elliottco.com

|

| |

|

3316-A

Battleground Avenue

Greensboro, NC 27410 |

Toll

Free 800-854-5889

Fax 336-854-7734 |

| |

|

If you wish to be REMOVED from our

e-mail list

click

here. |

|