|

ELLIOTT® ANNOUNCES PERSONAL AND

BUSINESS

PROPERTY EVALUATION SERVICE

ELLIOTT® & Company Appraisers has for a long time

promoted the fact that it performs all types of real estate

appraisals, as well as other evaluations, research, consultation and

representation on real estate issues. The company announces that it

also handles appraisals in areas besides real estate, including

appraisals of industrial and office equipment, office and home

furnishings, business valuations, appraisals of estate properties

and insurance replacement evaluations. ELLIOTT® & Company Appraisers has for a long time

promoted the fact that it performs all types of real estate

appraisals, as well as other evaluations, research, consultation and

representation on real estate issues. The company announces that it

also handles appraisals in areas besides real estate, including

appraisals of industrial and office equipment, office and home

furnishings, business valuations, appraisals of estate properties

and insurance replacement evaluations.

“In our 30 years of real estate valuation, we have

acquired the expertise of utilizing our skills outside of real

estate,” said Charlie Elliott, MAI, SRA, ASA, president of ELLIOTT®

& Company Appraisers. “As in the case of our real estate work,

ELLIOTT® can perform non-real-estate work in any county of any state

in the United States, as well as most foreign countries.”

For more information visit our Web site at

www.appraisalsanywhere.com or call our Client Services

Department at (800) 854-5889.

FANNIE WILL REQUIRE MORE INTERIOR

PHOTOS

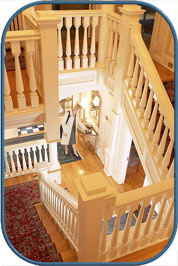

Beginning September 1, Fannie Mae will require that photographs of

specific rooms and interior areas be included in appraisal reports

when the appraiser makes an interior inspection of the property.

This new rule is part of Announcement SEL-2010-09, issued June 30 by

John Forlines, Fannie’s vice president and single-family chief risk

officer. Beginning September 1, Fannie Mae will require that photographs of

specific rooms and interior areas be included in appraisal reports

when the appraiser makes an interior inspection of the property.

This new rule is part of Announcement SEL-2010-09, issued June 30 by

John Forlines, Fannie’s vice president and single-family chief risk

officer.

Also in the announcement, Forlines stated the GRE’s position of

geographic competence of appraisers.

“Lenders are reminded that appraisers must have the requisite

knowledge to perform a professional quality appraisal for the

specific geographical location and particular property types,” the

Fannie VP wrote in the announcement. “The use of an appraiser who

has the appropriate knowledge of specific geographical location and

particular property types within those markets, access to the

appropriate data sources, and experience in appraising specific

property types within those markets will help to ensure that

valuations are accurate and that appraisal practices are

appropriate. Although the Uniform Standards of Professional Appraisal Practice (USPAP)

allows an appraiser who does not have the appropriate knowledge and

experience to accept an appraisal assignment by providing procedures

with which the appraiser can complete the assignment Fannie Mae

requires that lenders only use appraisers who have the appropriate

knowledge, experience, and access to appropriate data must not be

utilized.”

This announcement can be viewed on the Fannie Mae Web site.

CENSUS REPORTS THAT HOME SIZES ARE DECLINING

According

to the U.S. Census Bureau, the average size of a new single-family

home in this country dropped last year, reversing a trend that had

gone on for about 30 years. According

to the U.S. Census Bureau, the average size of a new single-family

home in this country dropped last year, reversing a trend that had

gone on for about 30 years.

“We also saw a decline in the size of new homes when

the economy lapsed into recession in the early 1980s,” said David

Crowe, chief economist of the National Association of Home Builders.

“The decline of the early 1980s turned out to be temporary, but this

time the decline is related to the phenomena, such as an increased

share of the first-time homebuyers, a desire to keep the energy

costs down, smaller amounts of equity in existing homes to roll into

the next home, tighter credit standards and less focus on the

investment component of buying a home. Many of these tendencies are

likely to persist and continue affecting the new market for an

extended period.”

OIL

STRIKES GULF COAST REAL ESTATE MARKETS

Oil has struck the Gulf Coast in a way property

owners don’t want. Virtually all property owners would appreciate

learning that an abundant supply of crude oil is underground on

their land and would therefore inflate the property’s value.

Unfortunately, the type of oil striking the property owners is

floating in from the Gulf of Mexico in the form of sludge and tar

balls, as a result of the explosion of the Deepwater Horizon rig on

April 20. Since that mishap, property values along the Gulf Coast,

even in areas where spilled oil has yet to be discovered, have

dropped. That makes the situation, already affected by the real

estate meltdown and rising unemployment that followed, even more

complex.

“It’s scaring people off,” Dale Peterson, a Destin,

Fla., Realtor, said of the oil spill, which has yet to physically

taint the beaches in his area. “It’s a wait and see. It’s the

not-knowing that’s the hardest part for us.”

Government leaders along Florida’s Gulf Coast are

pushing for a special session in the state legislature to tax

property owners on current values instead of the values before the

BP oil rig explosion.

“The market value on January 1 is a lot different

than the market value now,” said Florida Rep. Dave Murzin of

Pensacola. “The potential buyers, just like vacationers, aren’t

coming down here because they think the oil is soaked on the

beaches.”

If property taxes are reduced because of this, the

state would probably ask for compensation from BP to make up for the

lost revenue.

“We think we see this train coming down that tunnel,”

said Pete Smith, a real estate appraiser in Florida’s Gulf Coast

area. “If there is any way we can make it less disastrous, that is

what we are trying to do.”

ALMOST A THIRD OF FIRST QUARTER HOME SALES

WERE FORECLOSURES

A June 30 report by RealtyTrac, which bills itself as “the leading online marketplace of

foreclosed properties,” concluded that 31% of residential real

estate sales in the first quarter of this year were of properties

that had been foreclosure. The report, called the U.S. Foreclosure

Sales Report, also noted that foreclosed properties, during that

quarter, sold at an average of 27% below the average price of homes

not in foreclosure.

“First-time

homebuyers and investors continue to buy foreclosure properties in

large numbers, and at substantial discounts,” said RealtyTrac CEO

James Saccacio. “As lenders have begun repossessing homes at record

levels over the first half of 2010, it will be interesting to watch

how they will manage the inventory levels of distressed properties

on the market in order to prevent more dramatic price

deterioration.”

ASK MARTITIA

QUESTION:

A client,

who has obtained two appraisals of the same property, asks a third

appraiser to review both appraisals and reconcile them, giving the

property a single value. Can the third appraiser carry out the

assignment under USPAP guidelines?

MARTITIA:

Yes, this

type of review assignment is acceptable under the Uniform Standards

of Professional Appraisal Practice. Under these circumstances, it

would be appropriate for the appraiser to include the results of

both reviews, as well as the appraiser’s opinion of value within the

same report.

Martitia Mortimer, Elliott’s executive vice president, answers

appraisal questions on a regular basis in Elliott Real Estate

News.

QUOTES

“Liberty,

when it begins to take root, is a plant of rapid growth.” –

George Washington

“My

chief want in life is someone who shall make me do what I can.” –

Ralph Waldo Emerson

“The heights charm us, but the steps do not.”

– Johann von Goethe

“Self-reliance is the only road to true

freedom, and being one’s own person is its ultimate reward.”

– Patricia Sampson

“The flag is the embodiment not of sentiment,

but of history.” – Woodrow Wilson

|

| |

| Newsletter Editor:

kevin@elliottco.com

|

| |

|

3316-A

Battleground Avenue

Greensboro, NC 27410 |

Toll

Free 800-854-5889

Fax 336-854-7734 |

| |

|

If you wish to be REMOVED from our

e-mail list

click

here. |

|