|

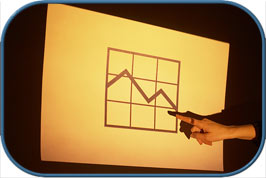

REPORTS GALORE

OF DECLINING HOME VALUES

The

U.S. Census Bureau, CoreLogic, Standard & Poor’s and other

organizations issued third-quarter reports of declining home prices

and predictions of further depreciation in the average price of U.S.

homes. The

U.S. Census Bureau, CoreLogic, Standard & Poor’s and other

organizations issued third-quarter reports of declining home prices

and predictions of further depreciation in the average price of U.S.

homes.

The Census reported last month that the average home price fell last

year to $185,200, a 5.8% decline from the previous year. The

municipality with the highest average home value was San Jose,

Calif., at $638,300. Four other California cities placed in the top

ten in this category, while New York, Washington, Boston, Seattle

and Baltimore rounded out this exclusive list. McAllen, Texas, had

the lowest of all U.S. municipalities with an average home value of

$76,100.

A CoreLogic report issued last week said that home prices in the

United States have dropped for two consecutive months. According to

analysts at Standard & Poor’s, this trend will continue. The company

recently issued a report predicting a decline in home values of 7%

to 10% through the end of next year.

“We’re continuing to see price declines across the board with all

but seven states seeing a decrease in home prices,” Mark Fleming,

CoreLogic’s chief economist told Carrie Bay, a reporter for DSNews.

“This continued and widespread decline will put further pressure on

negative equity and stall the housing recovery.”

FARMLAND PRICES INCREASE 10% IN

MIDWEST

With

real estate prices falling in most sectors, the increase in the

price of farmland, at least in the Midwest, is turning out to be a

notable exception. The Federal Reserve Bank of Chicago reported last

week that farmland prices in the Midwest rose 10% in the third

quarter of this year compared to what it was in the third quarter of

last year. With

real estate prices falling in most sectors, the increase in the

price of farmland, at least in the Midwest, is turning out to be a

notable exception. The Federal Reserve Bank of Chicago reported last

week that farmland prices in the Midwest rose 10% in the third

quarter of this year compared to what it was in the third quarter of

last year.

An increase in farm prices and the lower price of credit were

reported be the reasons for the dramatic jump in land prices in the

Fed’s Seventh District, which covers Illinois, Indiana, Iowa and

Wisconsin. This region is a leading producer in corn, soybeans, pork

and dairy products.

“We had strong credit [and] strong land-value growth a couple of

years ago, and then things changed pretty dramatically with lower

corn and soybean prices,” Federal Reserve economist David Oppedahl

told Christine Stebbins, a reporter for Reuters News. “Now there was

a surge in those, so we have a much more favorable situation again

this fall.”

MBA REPORTS

SIGNIFICANT INCREASE IN

COMMERCIAL MORTGAGE ORIGINATIONS

The Mortgage Bankers Association (MBA) reported

earlier this month that third-quarter commercial and multifamily

mortgage-loan originations increased 32% from what they were in the

third quarter of last year and 15% above what they were in this

year’s second quarter. Originations for health-care real estate

properties increased by 84% over what they were in the previous

quarter.

“Today’s low interest rates make for a very

attractive borrowing environment,” said Jamie Woodwell, vice

president of commercial real estate research of the MBA. “However,

relatively low levels of loan maturities and a slow, albeit rising,

sales market continued to dampen overall commercial mortgage

demand.”

MANHATTAN

DOMINATES TOP U.S. COMMERCIAL REAL ESTATE DEALS

Google

has reportedly shown interest in purchasing the exclusive building

at 111 Eighth Avenue in New York from Taconic Investment Partners.

The Internet search-engine company is considering paying almost $2

billion for the 200,000-plus square-foot building where it leases

space for its second-largest engineering center. Google

has reportedly shown interest in purchasing the exclusive building

at 111 Eighth Avenue in New York from Taconic Investment Partners.

The Internet search-engine company is considering paying almost $2

billion for the 200,000-plus square-foot building where it leases

space for its second-largest engineering center.

If the sale goes through for anywhere near that

price, it would mean that the top six priciest commercial real

estate transactions involved property in Manhattan. Currently the

top five commercial transactions in U.S. commercial real estate

history are: (1) Stuyvesant Town, the 110-building, 14-story

apartment complex at $5.3 billion; (2) the GM Building at $2.8

billion; (3) Rockefeller Center at $1.85 billion; (4) 665 Fifth

Avenue at $1.8 billion; and (5) Worldwide Plaza at $1.74 billion.

PROMINENT

FORECLOSURE LAWYER

FIGHTING HIS OWN FORECLOSURE

Peter Ticktin, an attorney in South Florida who has

made national attention for his strategic defense against home

foreclosures, is also battling to keep his own house from being

foreclosed upon. An article in the South Florida Sun Sentinel said

he and his wife have not made a mortgage payment on their

3,920-square-foot home in a fashionable neighborhood in Orlando

since December of 2006.

“It’s embarrassing that I’m in foreclosure,” Ticktin

told reporter Diane Lade. “But I now understand my clients better

than some lawyers who never had a problem in their lives.”

ASK MARTITIA ASK MARTITIA

QUESTION: A client tells his appraiser that he wants the

appraiser’s final value sent to him via text message or instant

message. Does such communication constitute an appraisal report that

must comply with USPAP?

MARTITIA: Yes. Text messages

and instant messages by an appraiser concerning his or her opinion

of final value to a client are indeed appraisals and subject to

Uniform Standards of Professional Appraisal Practice. For that

matter, oral appraisal reports must meet USPAP guidelines.

Martitia Mortimer, Elliott’s executive vice president, answers

appraisal questions on a regular basis in Elliott Real Estate

News.

QUOTES

“We make a living by what we get, but we make a life

by what we give.” – Winston Churchill

“You cannot spend your way out of recession or borrow your way

out of debt.” – Daniel Hannan

“Whenever a man has cast a longing eye on offices, a rottenness

begins in his conduct.”

– Thomas Jefferson

“Life is like playing a violin solo in public and playing the

instrument as one goes on.”

– Samuel Butler

“Nothing is a waste of time if you use the experience wisely.”

– Auguste Rodin

“We can lick gravity, but sometimes the paperwork is

overwhelming.” – Wernher von Braun

“You may delay, but time will not.” – Benjamin Franklin

|

| |

| Newsletter Editor:

kevin@elliottco.com

|

| |

|

3316-A

Battleground Avenue

Greensboro, NC 27410 |

Toll

Free 800-854-5889

Fax 336-854-7734 |

| |

|

|

To unsubscribe from our mailing list, please

click here. |

|