Asset Management

Whether it be for property tax assessment, estate planning, insurance coverage, project feasibility, cost analysis, taking by others, market analysis, due diligence, or pre-sale consideration, we'll get you the answers you need to properly manage you or your client's asset.

Business evaluation or analysis will consider the business' assets, going concern or business value and good will.

Read MoreA business valuation or business appraisal will consider many factors including real estate holdings, going concern, goodwill, FF&E and any hard assets and cash flow.

Read MoreCasualty loss appraisal involves appraising a property to determine the loss after a catastrophic event such as a fire, flood, hurricance, or tornado in which a property may be wholly or partial loss, to pay out on the insurance claim and make the owner whole.

Read MoreChange of use study or analysis to determine the highest and best use or most productive use of a property is necessary to maximize its economic returns to the owner.

Read MoreCharitable contribution appraisal involves valuing properties that are considered a non cash gift to a charity so that a charitable deduction can be taken using IRS form 8283.

Read MoreComparable rental data and market rents needed to determine feasibility of an income producing property or project can be analyzed to determine profitability.

Read MoreCondemnation or taking of part of your bundle of rights in your property can result in a diminution in value to your property.

Read MoreConservation easement appraisal and valuing conservatory grants involves valuing the property with consideration of the loss of a portion of its bundle of rights.

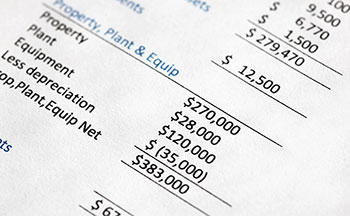

Read MoreCost segregation study or cost segregation analysis provides an accelerated depreciation of some improvements on properties therefore reducing income taxes paid.

Read MoreDeferred maintenance analysis is used to place a value on the state of disrepair or deteriorating condition of properties and determine a cost to cure to bring the property back to normal condition.

Read MoreDiminution in value appraisal or DIV appraisal is often used in condemnation actions and title claims to value a property considering its unimpaired value, its impaired value, and then its diminished value.

Read MoreDivorce settlement evaluation will help determine the value of jointly owned property or marital assets that need to be split to obtain equitable distribution.

Read MoreDue diligence anlysis or due diligence study is the process of collecting and verifying property characteristics to determine feasibility for a project.

Read MoreEminent domain appraisals or the valuing of taking of real estate or loss of property often involves an unimpaired value, and impaired value, and the resulting diminution in value.

Read MoreEnvironmental damage appraisal or appraising contaminated properties will assess the material impact of environmental damage such as soil contamination, contaminated buildings or contaminated streams on the market value of each property.

Read MoreEnvironmental damage assessment or assessing the diminution in value to a property due to chemical leaching or other hazards will often be required from the EPA or for use in assessing material damage.

Read MoreEquipment valuation and appraisal will evaluate your assets as either real property or personal property depending on if it is permanently affixed or not.

Read MoreEstate planning and appraisal involves determining the valuation of real estate assets for an executor or estate to best decide where those assets need to be held after death.

Read MoreAn estate settlement evaluation may be used by an administrator or executor of an estate to determine market value of benefactor assets before being distributed to heirs.

Read MoreA feasibility study for a proposed development or project should include preliminary plans, financial statistics, projections and conclusions to determine the anticipated return on investment.

Read MoreFinancial reporting appraisal or apraising for the purposes of financial reporting is done for the purposes of corporate and individual financial statements where one may need book value, or market or fair value depending on the regulations that they must adhere to.

Read MoreHighest and best use for a property is often determined by an HBU analysis or vacant land studies to maximize economic return of the property.

Read MoreInsurance coverage counseling can help insure that your insured property has the correct amount of casualty insurance and limits of coverage.

Read MoreLiquidation counseling assists in the disposition or sale of unwanted properties and bank owned real estate and portfolio management.

Read MoreMarket rent appraisal will utilize market rents or what the market dictates that the space should bring to determine rental value. Market rent appraisals can be done for commercial or residential properties.

Read MoreMarket study looks at market indicators and market data for a geographic area to determine feasibility for a major project.

Read MorePartial interest appraisal or valuing an undivided interest in real estate is often used with tenants in common, partnerships, or life estate interests.

Read MoreProbate counseling for administrators and executors of estates is an invaluable tool to ensure equitable distribution of real estate assets between heirs.

Read MoreProperty tax abatement and appeals determines current property values in order to assist in updating county records at your local tax department or assessor.

Read MoreREIT counseling and REIT analysis for real estate investment trusts provides strategic answers and asset valuation for investment portfolios.

Read MoreREIT property valuation or portfolio appraisal of assets for institutional investors is often needed to determine performance and possible equity return.

Read MoreReplacement cost evaluation or providing an actual cash value to measure losses for insurance replacement will be conducted by an appraiser familiar with replacement cost new as well as depreciating the improvements.

Read MoreRetrospective appraisal or providing an opinion of retrospective value as of an effective date in the past is often completed for property disputes, income tax cases or estate settlements.

Read MoreSalvage value appraisal or the value of demolished improvements or salvage materials may exist in the course of redevelopment when older much more depreciated improvements make way for redevelopment of a site.

Read MoreSensitivity analysis or sensitivity study will measure consumer reaction and emotional response to a particular type of real estate or development to drive motivation of their purchasing decisions.

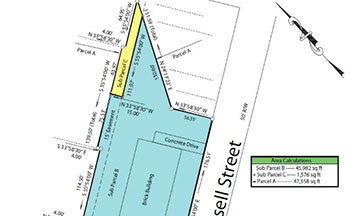

Read MoreSubdivision appraisal or subdivision analysis involves valuing raw land for its highest and best use or valuing the land as a subdivision to determine its feasibility.

Read MoreA tax value analysis looks at the market value of your property to determine if the mass appraisal figure that property tax departments use for your tax assesment is accurate.

Read More